As I write this, the price of Bitcoin has been plunging. I now realize I have blogged about Bitcoin a couple of times at this point, and it’s not really my intention to make this a bitcoin blog, rather a blog about my journey to a retirement abroad.

Bitcoin is a piece of that strategy. Having gotten into Bitcoin now over two years ago, what was initially a fairly small piece of my strategy has grown into a somewhat large piece, comparable to say my IRA Rollover from prior employers.

Developing a Strategy

I did have some rules in terms of going into Bitcoin, it did seem like a risky asset compared to say, putting my money in a S&P 500 mutual fund, so some additional rules seemed necessary. After all, I was getting into Bitcoin back in March of 2019, we had already seen the first big drop from nearly $20,000 to where I entered the market, around $3,500.

Rules I had for Investing in Crypto

- Stop investing in Bitcoin once the price reached $10,000. Stop Investing in Ethereum once the price reached $1,000

- Don’t invest more than 5% of my net worth in crypto

- Only invest new money in crypto

- Hold for at least a year

The First rule was probably the one that I stuck to best, and resulted me in essentially shutting down my new crypto investments towards the start of 2021. The price of Bitcoin breached 10,000 in the late summer of 2020, so I stoped buying more of that. I was not buying Ethereum as heavily as Bitcoin, and once its price exceeded $1,000 in the start of the year, I stoped enteirely. At that point, I had only invested about 2.5% in crypto.

From time to time since I have been tempted to buy additional crypto, and have at times had FOMO as the price of Bitcoin briefly exceeded $60,000, 6 times my stop price. Indeed, I was also doing pretty well myself during this time, as my 2.5% in crypto grew up to be about 20%, as crypto was doing significantly better than my other investments in 2021 through April.

I also purchased a trace amount of Binance Coin, BNB, which over the past couple of weeks, I have been selling so I can enjoy the fun of Yield Farming on Pancake Swap. This was under $200 worth, so I don’t really consider this to be an investment, rather, something to play around with.

I also violated my fourth rule of holding for at least a year, as I sold off a bit of Bitcoin in the beginning of April, when I decided I was getting a bit uncomfortable with how exposed I was to crypto.

May

May started off well enough. Elon Musk was going to host SNL, and crypto twitter was going nuts that he would say some remark about Bitcoin or Dogecoin that would cause the market to jump. Never really understood that.

Later that week though Elon tweeted that he was concerned about the amount of dirty energy that Bitcoin was using, and that he would not longer be accepting Bitcoin for payment of Tesla’s, not that anyone was really using Bitcoin to buy their Tesla’s to begin with. For someone like myself, the tax hit on exchanging Bitcoin for a car would be massive. This did however cause the Bitcoin community to freak out, and sent the price plunging, as people speculated that Elon and Tesla would now begin the process of selling their holdings.

Then, last night then, I saw an alert that a spokesperson for the Peoples Bank of China (PBOC) essentially said that Bitcoin was not a suitable payment for anything. Not really news, after all, they have been saying this for a while. Here in America, our own Federal Reserve has been saying this for a while, though perhaps not as bluntly. Crypto does call into their question their roles as the world’s central bankers, so their skepticism towards the asset is somewhat expeceted.

Reaction

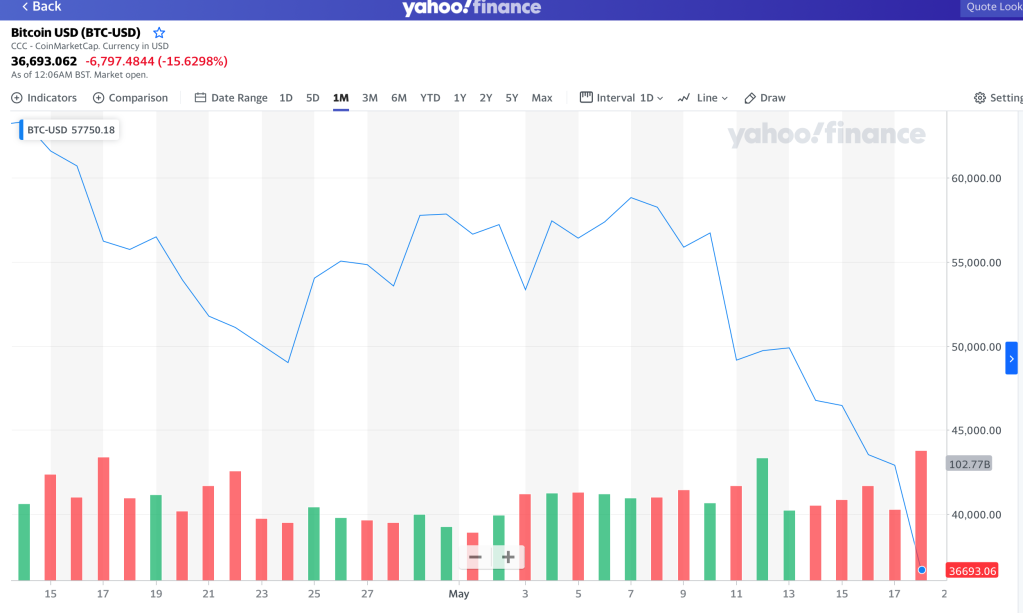

This has caused a lot of people in crypto twitter to freak out, particularly the people who got into crypto in the past few months. As I write this, Bitcoin, which was just a few weeks ago, over $60,000, has plunged to around $35,000.

I’m not expecting Bitcoin to go under $10,000 again. Though if it did, perhaps I should consider buying more, since my above strategy would again be in play. More likely though, I will simply hold what I have, and wait to see what the market does next. Crypto is a small enough part of my investment, and by sticking to my strategy, I can look at looses like I am seeing today, and not seeing it affect me.

Back to Strategy

This all brings me back to my strategy, as a day like today makes me really glad I wasn’t buying additional crypto a few weeks ago, when everyone else was getting rich, and I was just, well, sitting there. I can now handle the drops like today. If my crypto portfolio goes to 0, I can shrug it off. Not all my investments make money, but by keeping myself diversified, I can minimize the impact of days like today.